How to Have Complete Confidence In The Accuracy Of Your Numbers By Surrounding Yourself With The Appropriate Team

Accounting and finance can be a real strain for management if you don’t have the right team in place. You may find much of your time is spent trying to keep up with the day-to-day bookkeeping, getting bogged down answering audit queries (depending on the nature of your organisation), or worse still, spending no time on important accounting tasks. You may even be relying on team members to take on the accounting and bookkeeping role without sufficient training or strategic thinking you would gain from an experienced financial controller or management accountant. All of these scenarios have one thing in common: They can end in disaster!

However, you can gain confidence in the accuracy of your numbers by surrounding yourself with the appropriate team to help gain control of your financials.

Here’s how to think about putting together the right accounting team to suit your organisation's size and resources.

The Roles of a Finance Function

First, you need to understand the individual roles that comprise a finance function including:-

Bookkeeper

Your bookkeeper is the person who keeps things organised at the day to day transactional level. Their role is important as they record and classify your daily financial transactions like sales, payroll, invoices, bill payments, etc. They lay the foundations and are at the root of your numbers and their accuracy. In essence, the significance of high-quality bookkeeping cannot be understated. However, as the record keeper, a bookkeeper may not have the necessary skillset and experience to analyse or interpret what the numbers are saying about the business.

Accountant

So why do you need an accountant if you already have a bookkeeper? While your bookkeeper is maintaining the day to day record keeping, your accountant takes what the bookkeeper records and uses the data to analyse and provide insight and a financially driven strategy.

Financial Controller

Your financial controller is a big picture numbers person. They are concerned about accuracy while also helping determine how your money is allocated. Cash management is their main concern, with a no-nonsense approach to your finances. They ensure you are 100% confident in what the numbers are telling you.

External Tax Accountant

With constant changes to tax law, you need a tax advisor who not only helps ensure you remain compliant with your lodgements but also helps you take advantage of all the tax advantages legally available to your business. Their goal is to minimise your tax obligations legally, ensure you always remain compliant and ultimately maximise your after-tax wealth.

Generally speaking, the external accountant is usually solely focused on compliance and making sure your tax obligations are under control.

Consulting Chief Financial Officer (CFO)

Without a CFO at the helm of your accounting and finance function, you miss out on discovering the strategic goals needed to help drive profits and your organisation’s strategic initiatives. This role sits at the top of the accounting team and oversees all accounting functions, ensuring you have a system in place, so the rest of the team is following accounting best practices. Whereas your financial controller and accountant are the ears and eyes of your financials, your consulting CFO is the brains. They are brilliant forecasters who think through the consequences of financial decisions to ensure you steer clear of disaster and head towards profitable seas.

Ideally, your team structure will be determined by your business setup, which means you have the key roles suitable for the nature and size of your organisation.

The Right Roles for Your Needs

Now that you understand the key individual roles that comprise a finance function, you can drill down and formulate a team that suits your type of organisation. Logically smaller businesses can manage with less, while larger companies can add a few additional team members to keep things streamlined, focused and efficient.

Therefore, you should consider your appropriate team as follows:

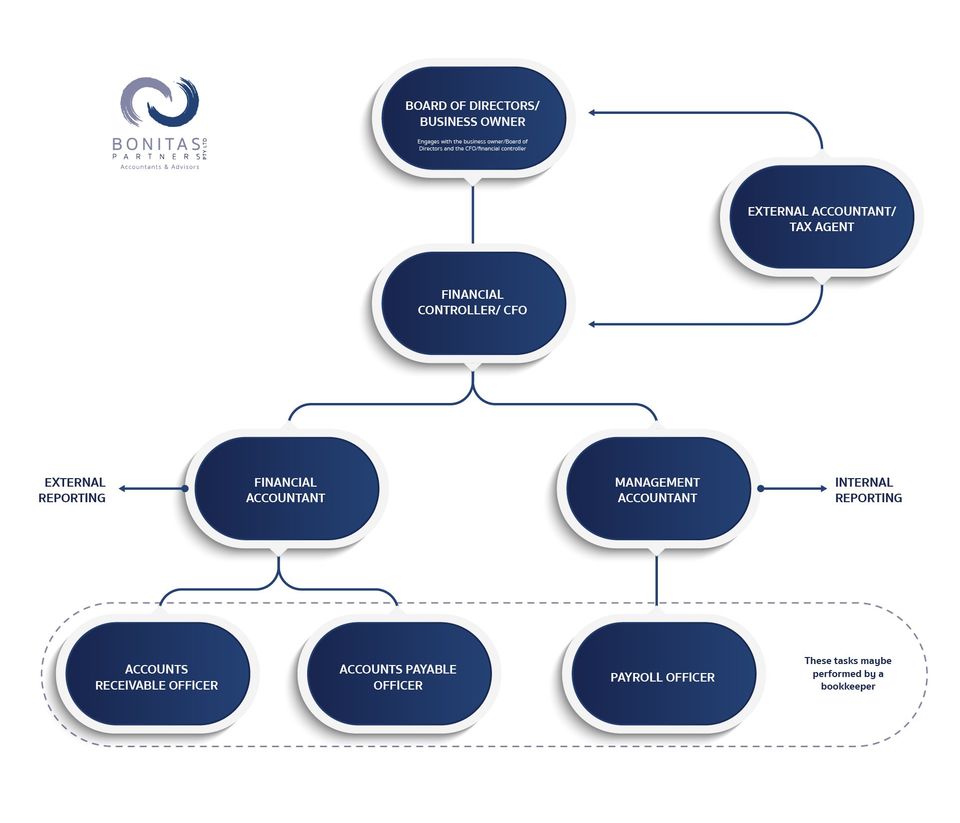

Established Small to Medium Businesses (SMEs):- as an established business, you want the full gamut to cover all bases. While smaller businesses can use the finance team as outlined above, medium businesses need to add to the group. In this case, you can break down your bookkeeping role into more specific task-based roles by including accounts payable, accounts receivable and payroll officers.

Click image to enlarge and download

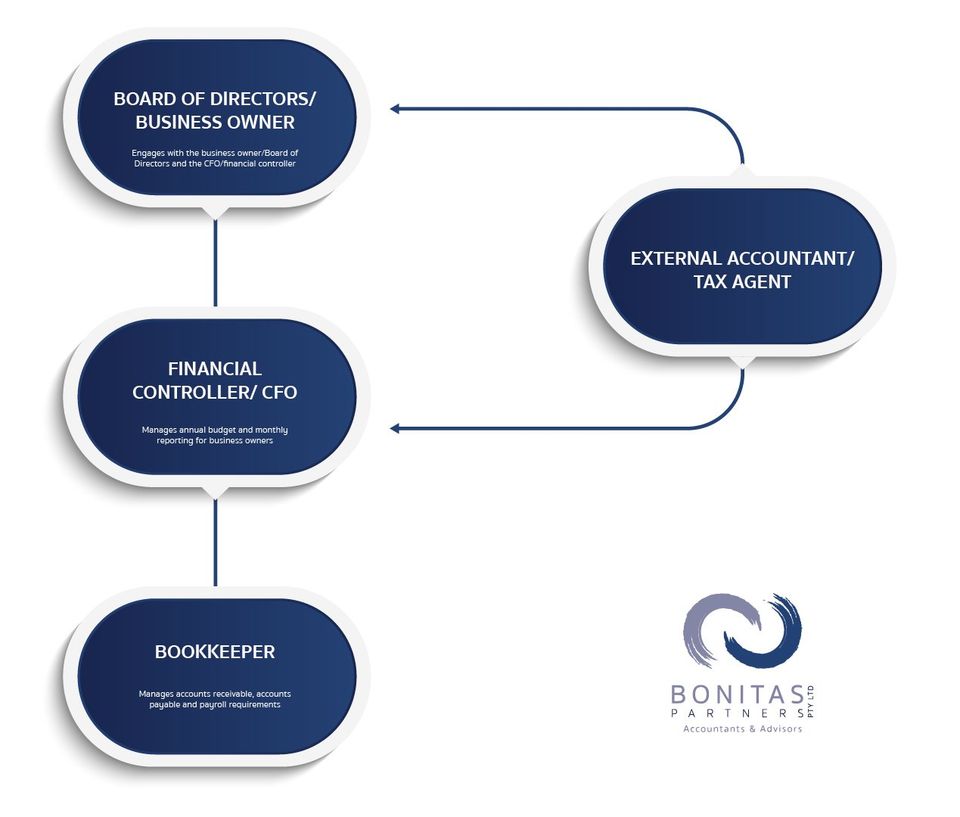

Micro Businesses or Not For Profits:- For the micro business with an annual turnover under $250,000, you can downsize your team to the core roles, including a combined financial controller/CFO, a bookkeeper, and your external tax accountant. The beauty of a solution like Bonitas Partners is that we can scale our engagements up or down, so you only pay for what you truly need.

Click image to enlarge and download

Not for profits have to ensure they understand acquittal reporting and the tax concessions for registered charities. So when choosing your external tax accountant, make sure you hire someone with not-for-profit and registered charity experience.

Accessing Accurate Numbers

With the appropriate team in place, you will have access to accurate and up to date numbers. Having confidence in your numbers empowers you to make the right decisions. The reason being you will gain insights you never had before. When you lack confidence in your numbers, you can falter on decisions or, worse still, trust the numbers and make decisions that may lead to dire consequences. Under or overestimating financial health, even by small amounts, can lead to poor judgement that impacts both your short-term and long-term goals.

Measurement for Success

Management guru Peter Drucker once said, “If you can’t measure it, you can’t improve it”. Nothing could be simpler or more true when it comes to accounting and your business performance. With the appropriate team in place, you have the right people focused on the right things. As a result, you have accurate and timely information at your fingertips, so you are constantly measuring and improving your performance.

It applies to all aspects of the business, from efficiencies in staffing to things such as inventory management, from finding capital to reinvest in the development of new products and services and being prepared to ramp up your team. This allows for real-time measurements so you can be more responsive and create a fluid business that is changing as the market changes and your opportunities grow.

Finding the right professionals to fill these roles can be a challenge. At Bonitas Partners Pty Ltd, we offer an easy solution with a team who knows what a properly run accounting department should look like. We take ownership and responsibility for your finances, so you finally have confidence in the accuracy of your numbers.